operating cash flow ratio negative

If OCF is negative it means a company has to borrow money to do things or it may not stay in business but it may benefit. Before splurging on new equipment software or employees weigh.

What Is Operating Cash Flow Ocf Definition Meaning Example

Year 1 Working Capital 140m 145m.

. The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt. Dividing -50000 by 500000 to get -01 or -10. Free cash flow is the cash that a company generates from its business.

An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales. Negative cash flow is when your business has more outgoing than incoming money. A good operating cash flow margin is typically above 50.

Operating cash flow is a measure of the amount of cash generated by a companys normal business operations. If a company has an operating cash flow margin of below 50 this suggests that the company is not efficiently. In Year 1 the working capital is equal to negative 5m whereas the working capital in Year 2 is negative 10 as shown by the equations below.

A company might have a negative cash flow from investing activities because management is investing in long-term assets that should help the companys future growth. You cannot cover your expenses from sales alone. Operating Cash Flow Ratio.

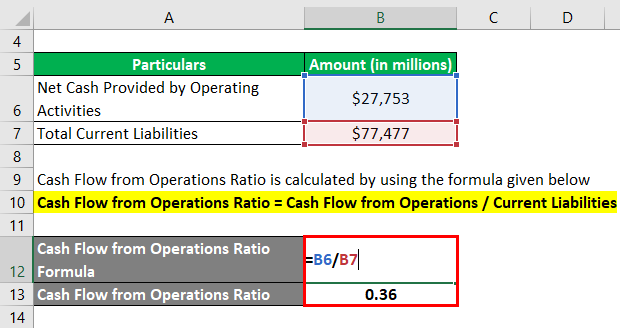

The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flow generated from a companys operations. Operating Cash Flow Total Revenue Operating Expense. When the ratio is low or negative it could be an indication that the company needs to adjust its operations and start figuring out which activities are sinking its income or.

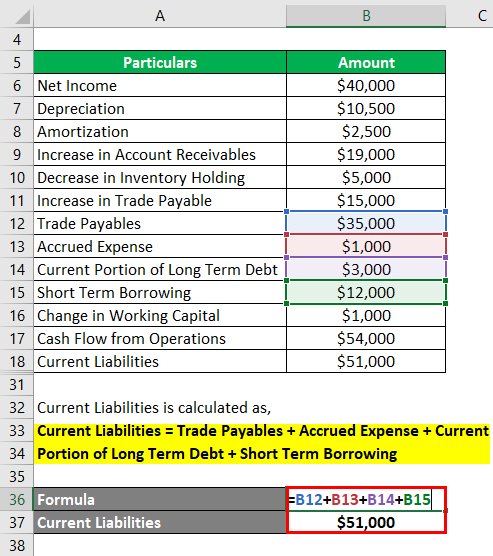

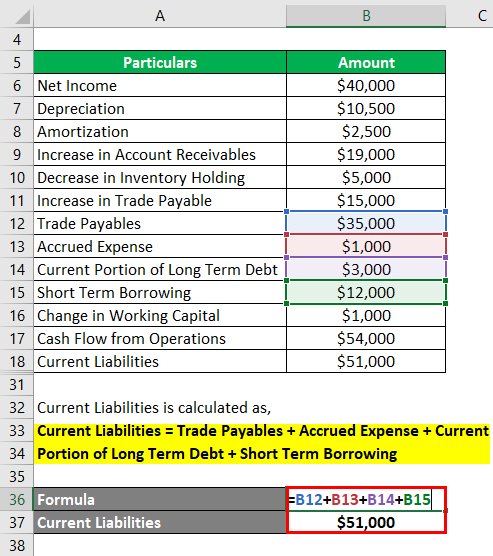

The formula to calculate the ratio is as follows. Cash Returns on Asset. Be mindful of your spending and investing.

Operating cash flow indicates. Operating Cash Flow Margin. Operating cash flow measures cash generated by a companys business operations.

The Operating Cash Flow Ratio is a liquidity ratio its a measure of how well a company can pay off its current liabilities with the cash flow generated from its core business. 500000 100000. Negative operating cash flow is a situation in which a company or business does not have access to the necessary funds when they are needed to meet expenses.

Use these five tips to get your cash flow back into the green. Lets consider the example of an automaker with the following financials. Operating Cash Flow - OCF.

In the second scenario above because the operating profit is negative the profit margin percentage will be negative. Cash returns on assets cash flow from operations Total assets. Instead you need money from.

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Price To Cash Flow Ratio P Cf Formula And Calculation Excel Template

Summary Of Cash Flow From Operations Abstract

Negative Cash Flow Investments In Companies

Negative Working Capital Causes And Cash Flow Impact Excel Template

Operating Cash Flow Formula Calculation With Examples

Negative Cash Flow Investments In Companies

Operating Cash Flow Ratio Calculator

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Price To Cash Flow Ratio P Cf Formula And Calculation Excel Template

Cash Flow From Operating Activities Direct And Indirect Method Efm

Negative Cash Flow Investments In Companies

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

Operating Cash Flow Ratio Definition And Meaning Capital Com

Operating Cash Flow Efinancemanagement Com

Cash Flow Ratios To Analyze Cash Sufficiency Of Companies Getmoneyrich

Price To Cash Flow Ratio Formula Example Calculation Analysis

Operating Cash Flow Ratio Formula Guide For Financial Analysts